Do It Yourself Taxes Online 9 Worst Home Improvement Projects That Decrease Resale Value

Salary Calculator Results. If you are living in California and earning a gross annual salary of $72,020 , or $6,002 per month, the total amount of taxes and contributions that will be deducted from your salary is $16,442 . This means that your net income, or salary after tax, will be $55,578 per year, $4,632 per month, or $1,069 per week.

215K Dollars Salary After Taxes in Nevada (single) [2023]? Smart Personal Finance

What is a $4.5k after tax? $4500 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax r.. Social Security Tax Due: $ 279.00: Medicare Tax Rate: 1.45%: Medicare Due: $ 65.25: State Tax Due: $ 87.00: Local Tax Due Due: $ 0.00:

States With High Taxes Face Grim Future in Tax Policy Revolution

Estimate your US federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using IRS formulas. The calculator will calculate tax on your taxable income only. Does not include income credits or additional taxes. Does not include self-employment tax for the self-employed. Also calculated is your net income, the amount you.

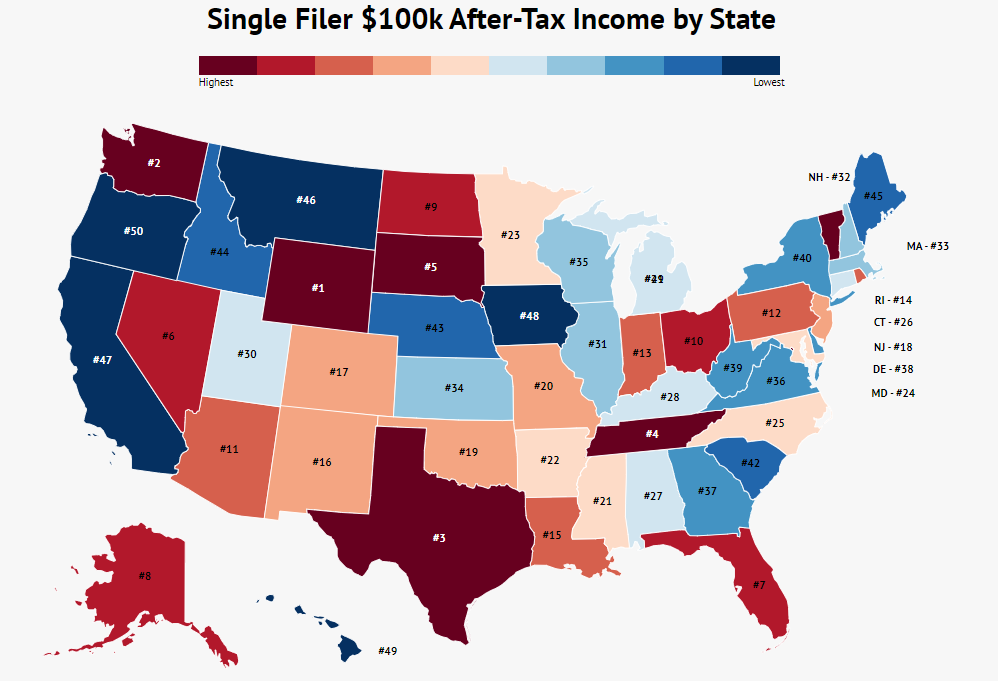

100k AfterTax By State [2023] Zippia

450,000.00 After Tax. This income tax calculation for an individual earning a 450,000.00 salary per year. The calculations illustrate the standard Federal Tax, State Tax, Social Security and Medicare paid during the year (assuming no changes to salary or circumstance).. 1.45%: Additional Medicare Tax Rate Applies [ Your income exceeds $200.

Life of Tax How Much Tax is Paid Over a Lifetime Self.

State taxes. Marginal tax rate 5.85%. Effective tax rate 4.88%. New York state tax $3,413. Gross income $70,000. Total income tax -$11,074. After-Tax Income $58,926. Disclaimer: Calculations are.

40 increase in pay, 7k after taxes, looks good but currently I'm only posting memes since there

The $450k after tax calculation includes certain defaults to provide a standard tax calculation, for example the State of Texas is used for calculating state taxes due.. Medicare Tax Rate: 1.45%: Additional Medicare Tax Rate (on earnings over $ 200,000.00) 0.9%: Medicare Due: $ 8,775.00: State Tax Due: $ 0.00: Local Tax Due Due: $ 0.00: Take.

3 Effective Tax Strategies for Investors — Chatterton & Associates

17.73. 81.97%. Tip: Social Security and Medicare are collectively known as FICA (Federal Insurance Contributions Act). Based on this calculation your FICA payments for 2024 are $3,442.50. The California income tax calculator is designed to provide a salary example with salary deductions made in California. You can choose an alternate State Tax.

CARPE DIEM Real AfterTax Profits Reach New Record High in Q4

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U.S. residents. The calculation is based on the 2024 tax brackets and the new W-4, which, in 2020, has had its first major.

How Much Tax Will I Pay On 50000 Uk Tax Walls

If you make $45,000 a year, you will make $3,461.54 a month before taxes, assuming you are working full-time. Each month after taxes, you will make approximately $2,596.15. A full-time worker or employee works at least 40 hours a week. If you work either more or fewer hours, this amount will vary slightly.

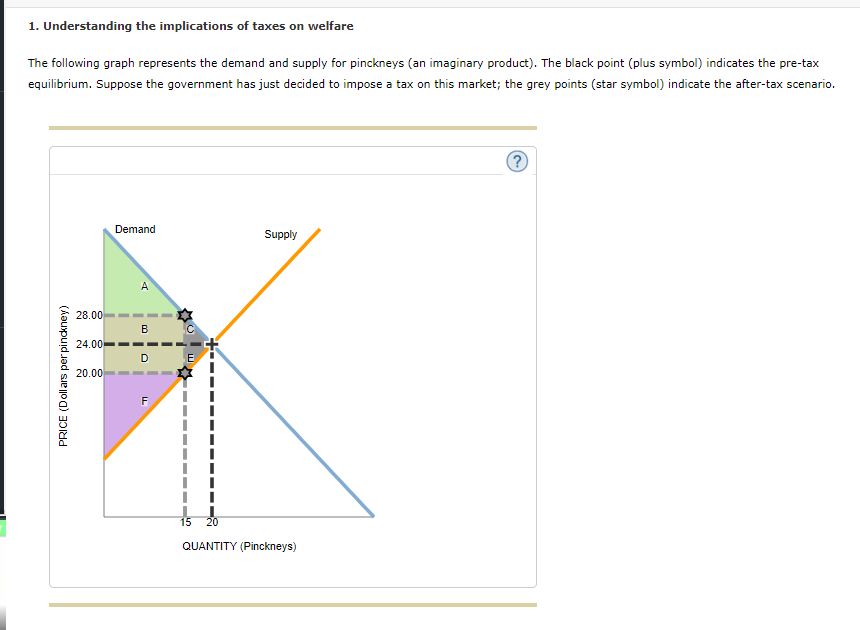

Solved 1. Understanding the implications of taxes on welfare

The table below details how Federal Income Tax is calculated in 2024. The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2024. Federal Tax Calculation for $45k Salary. Annual Income 2024. $ 45,000.00.

How much is 250,000 a year after taxes (filing single)? Smart Personal Finance

FICA is a two-part tax. Both employees and employers pay 1.45% for Medicare and 6.2% for Social Security. The latter has a wage base limit of $168,600, which means that after employees earn that much, the tax is no longer deducted from their earnings for the rest of the year. Those with high income may also be subject to Additional Medicare tax.

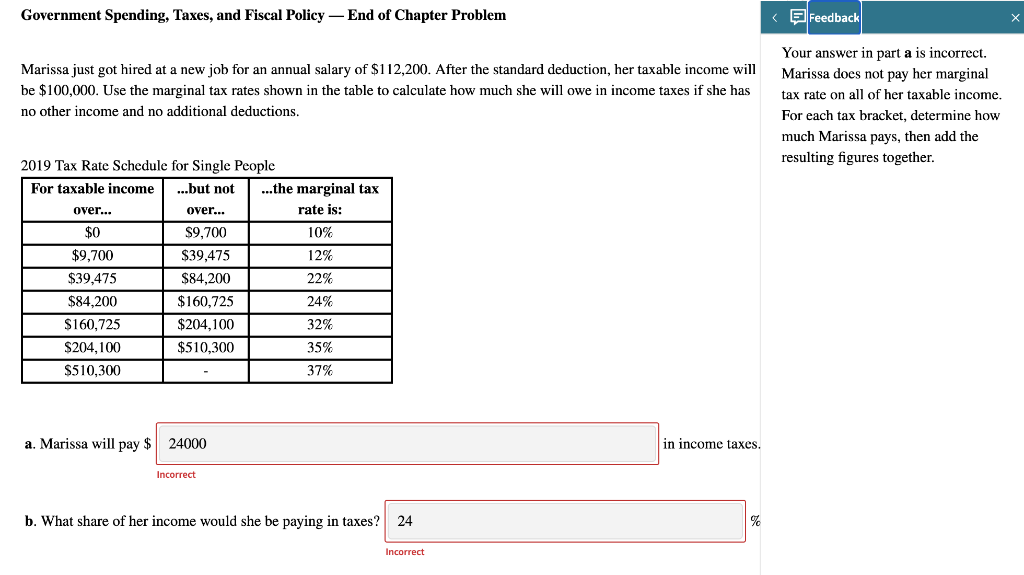

Solved Government Spending, Taxes, and Fiscal Policy End

Summary. If you make $45,000 a year living in the region of California, USA, you will be taxed $8,874. That means that your net pay will be $36,126 per year, or $3,010 per month. Your average tax rate is 19.7% and your marginal tax rate is 27.4%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Do I have to pay taxes on my workers’ compensation check? Law Office of Darren Shoen

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay, marital status, state and federal tax, and pay frequency. After using these inputs, you can estimate your take-home pay after taxes. The inputs you need to provide to use a paycheck tax calculator.

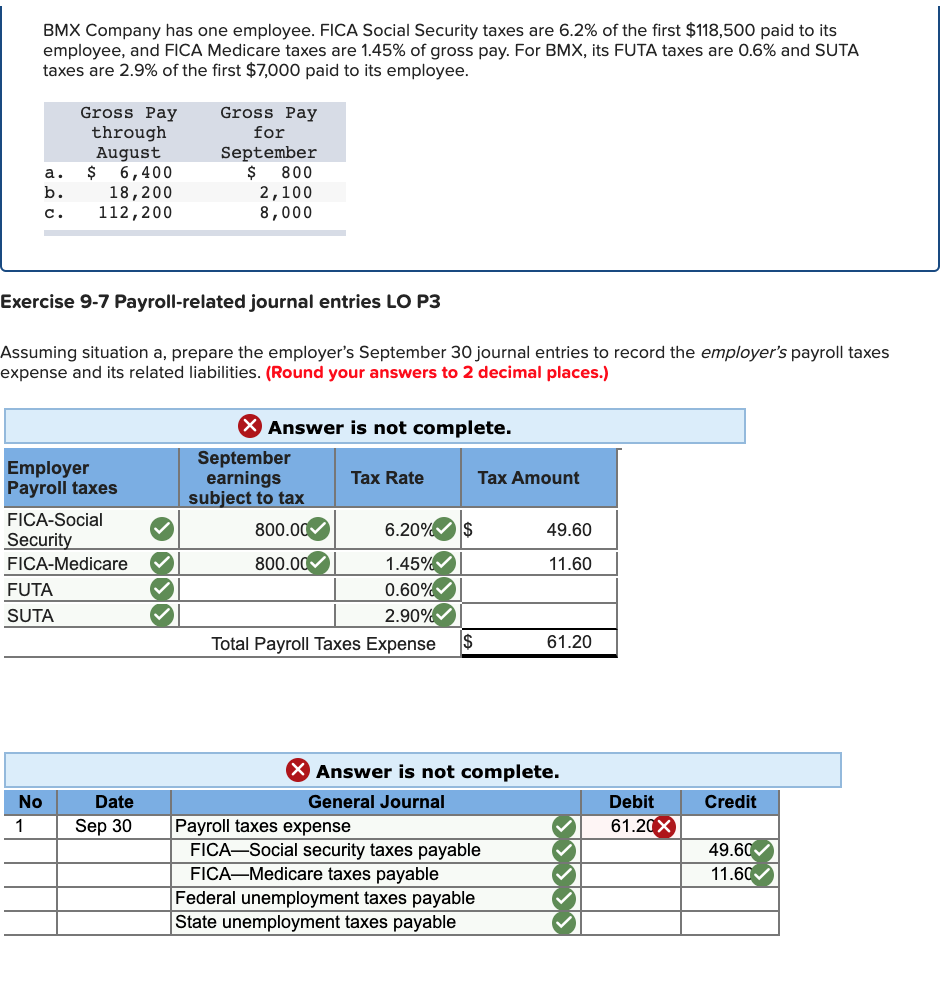

Solved BMX Company has one employee. FICA Social Security

Assuming an annual salary of $45,000, a federal tax rate of 22%, and a state tax rate of 4%, the estimated bi-weekly take-home pay after taxes would be approximately $1,316.92 per bi-week. Annual Salary - $45,000.00. Gross Bi-Weekly Pay - $1,730.77. Federal Tax Withholding - $379.23. State Tax Withholding - $69.23.

Yes, the top 1 pct do pay their fair share in taxes

IR-2024-112, April 17, 2024. WASHINGTON - The IRS encourages taxpayers to use the IRS Tax Withholding Estimator to ensure they're withholding the correct amount of tax from their pay in 2024.. This digital tool provides workers, self-employed individuals and retirees with wage income a user-friendly resource to effectively adjust the amount of income tax withheld from their wages.

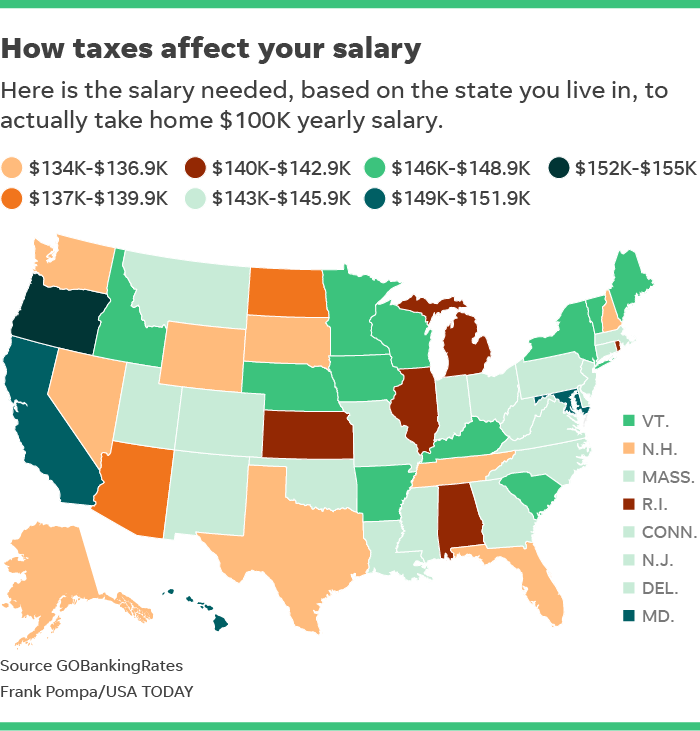

taxes How much you really need to earn to take home 100,000

To calculate this you need to know how many hours per year you work, then just divide $45,000 by that number. That means, if you work the standard 40 hour work week, 52 weeks per year, you'd need to divide $45,000 by 2,080 hours (40 * 52). If this is your measure, $45,000 per year is $21.63 an hour. However, if you freelance, side hustle or.

.